For Villa Investment:

(Speak to our Sales Team)

+91 788 788 1429

In real estate investing, returns aren’t just about appreciation, they’re about timing, cash flow, and long-term strategy. That’s where two powerful financial metrics come in: Internal Rate of Return (IRR) and Yield. Whether you’re buying a second home, investing in a vacation rental, or evaluating a land parcel, understanding these calculations helps you determine if a project is worth your money and when you'll get it back.

This blog is your go-to guide for understanding IRR and yield in real estate, how to calculate them, when to use them, and what they really tell you.

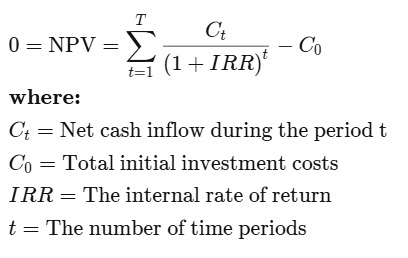

Internal rate of return, commonly known as IRR, is a parameter or metric used by investors to calculate the average return on investment. It’s one of the most powerful tools in the IRR real estate toolbox, helping investors assess expected returns from both existing and potential properties. IRR, when calculated, results in the percentage of annual return on investment. As it is the technical term, various factors are considered during the calculations of IRR. IRR is primarily concerned with two main factors: profit and time.

In any type of investment, profit is the monetary value you gain against your spending, may it be a rent or mortgage payment. However, profit metrics vary depending on your overall business or investment model. Profit is the ultimate boil-down point after you deduct associated amounts like property tax, maintenance, or any other costs. Time, on the other hand, is an important factor because it affects the value of property. The value your property yields today is not what it will yield some years down the line, and also in the future.

In simple terms, IRR helps answer:“How profitable is this investment per year, accounting for cash flows over time?” It is most useful when:

Calculating IRR manually is complex because it involves solving for a rate r in a non-linear equation. But in real estate, you can use simple tools like Excel or Google Sheets to calculate it accurately in minutes. Here’s how to calculate IRR using real-life property numbers.

Make a table of all the expected inflows and outflows over the investment period.

Example: Villa Investment

| Year | Cash Flow (₹) | Description |

|---|---|---|

| 0 | -80,00,000 | Initial investment (purchase cost) |

| 1 | +3,00,000 | Year 1 rental income |

| 2 | +4,00,000 | Year 2 rental income |

| 3 | +4,50,000 | Year 3 rental income |

| 4 | +5,00,000 | Year 4 rental income |

| 5 | +95,00,000 | Year 5 rental income + resale value |

Example in Excel:

A1: -8000000 A2: 300000 A3: 400000 A4: 450000 A5: 500000 A6: 9500000Place the cursor in an empty cell and type:

=IRR(A1:A6)

Press Enter. Excel will return a percentage, which is your IRR.

In this case, the IRR is approximately : 7.44%This means your investment yields a compounded annual return of 7.44% over the years, accounting for both rent and resale. This is why IRR real estate analysis is so critical, it lets you look at long-term return performance.

If you're not comfortable with Excel, try:

Just enter your cash flows and let the tool do the math.

You earn rent for a few years, then sell the property. IRR tells you the true return on your investment across years.

You hold a plot for 3–5 years and then sell it. If the appreciation is steep in later years, IRR helps measure that accurately.

You receive quarterly payouts + potential capital appreciation. IRR is useful for evaluating all cash inflows.

Yield is a simpler, more immediate measure of return. It tells you how much rental income you’re earning relative to your property cost or value. It considers factors like the invested amount and the current market value of your property. Yield is also calculated based on percentage.

Yield Formula:

How to calculate yield

Example:

Yield is helpful for:

| Metric | IRR | Yield |

|---|---|---|

| Considers Time Value? | Yes | No |

| Includes Resale Value? | Yes | No |

| Ideal For | Long-term analysis | Short-term rental returns |

| Cash Flow Type | Uneven (rent + sale) | Regular rent |

| Complexity | Higher, needs a tool | Simple % formula |

A higher IRR or Yield generally indicates a better-performing investment. Investors across the globe will want to understand the data points of return on investment. These metrics give you financial analysis to estimate the profitability of investing in the property. Hence, they act as guidelines for investors on whether to invest or not in a property. However, investors must also assess if the investment aligns with their risk profile, capital availability, and financial goals.

Understanding yield vs return through both lenses allows you to make smarter investment choices, especially when returns aren’t straightforward.

=IRR({-Cost, Rent1, Rent2, ..., Final Sale})

Same syntax: =IRR()

For real estate investors, IRR and Yield are great tools to evaluate risk, reward, and timeline. While Yield offers a straightforward look at rental income relative to property cost, IRR real estate calculations provide a more comprehensive view by considering the timing and magnitude of all cash flows throughout the investment's life. By understanding and applying both metrics appropriately, investors can make more informed and strategic decisions in the real estate market.

Don’t invest blindly. Crunch the numbers. Your future self will thank you.

(Talk to our Hospitality Team)