IRR and Yield - Things To Know Before Real Estate Investment

People prefer real estate investment because of the high returns it gives. However this rate of return depends on various factors. Cash flow varies every year, prices can go up or down; this market is subjected to real time changes and risks. Hence it is also important to know potential rate of return that property yields. Real estate investors calculate this with the help of several tools, but IRR and Yield are the most useful. Unlike stock market, real estate is a dynamic avenue. Different factors within and outside the market affect the value of property and rate of returns. Thus, for a beginner investor as well as senior investor it is necessary to understand IRR and yield.

What is IRR?

Internal rate of return commonly known as IRR is a parameter or metric used by investors to calculate average return on investment. IRR is a significant tool to understand expected return from existing property as well as potential property. IRR, when calculated, results into the percentage of annual return on investment. As it is the technical term, various factors are considered during the calculations of IRR. IRR is primarily concerned with two main factors: profit and time.

In any type of investment Profit is the monetary value you gain against your spending; may it be a rent or mortgage payment. However profit metrics varies upon your overall business or investment model. Whenever your gains are more than initial investment, it is considered as profit. Profit is the ultimate boil down point after you deduct associated amounts like property tax, maintenance or any other. Time, on the other hand is important factor because it affects the value of property. The value your property yields today is not what it yield some years down the line and also in the future.

What is Yield?

Yield is similar to what we understood as IRR. Yield is the earnings on your investment. It considers factors like invested amount and current market value of your property. Yield is also calculated on the basis of percentage. There is a method to calculate yield as well as IRR. While talking about IRR vs yield; main difference between is that, yield to maturity talks about investments which are already made. IRR can give you percentage of potential investment as well. Yield to maturity popularly known as YTM is a metric to calculate yield on current market price. Here the investment can be some sort of bond or other fixed income security. YTM calculation is more complex than IRR.

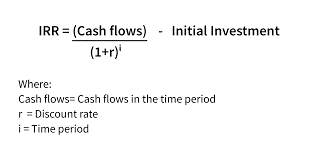

IRR and yield calculator is not so much about arithmetic. It can also be calculated with the help of simple tools like excel sheets. However technical formula for IRR and yield consider factor like annual rental income, property value, annual expenses, total investment, number of time period etc.

- Gross yield = (annual rental income/ property value) x 100

- Net rental yield = [(Annual rental income – Annual expenses) / Total property cost] x 100

- Internal rate of return=

A common parameter to remember in IRR and the yield is that if the final value turns out to be higher than investor can invest higher amount. It is the indicator of higher value of return with lower risk. Investors across the globe will want to understand the data points of return on investment. These metrics give you financial analysis to estimate the profitability of investing in the property. Hence they act as guidelines for investors whether to invest or not in a property.